sales tax in orange county california 2021

ICalculator US Excellent Free Online Calculators for Personal and Business use. The current total local sales tax rate in Orange County CA is 7750.

Who Pays The Transfer Tax In Orange County California

Orange County in California has a tax rate of 775 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Orange County totaling 025.

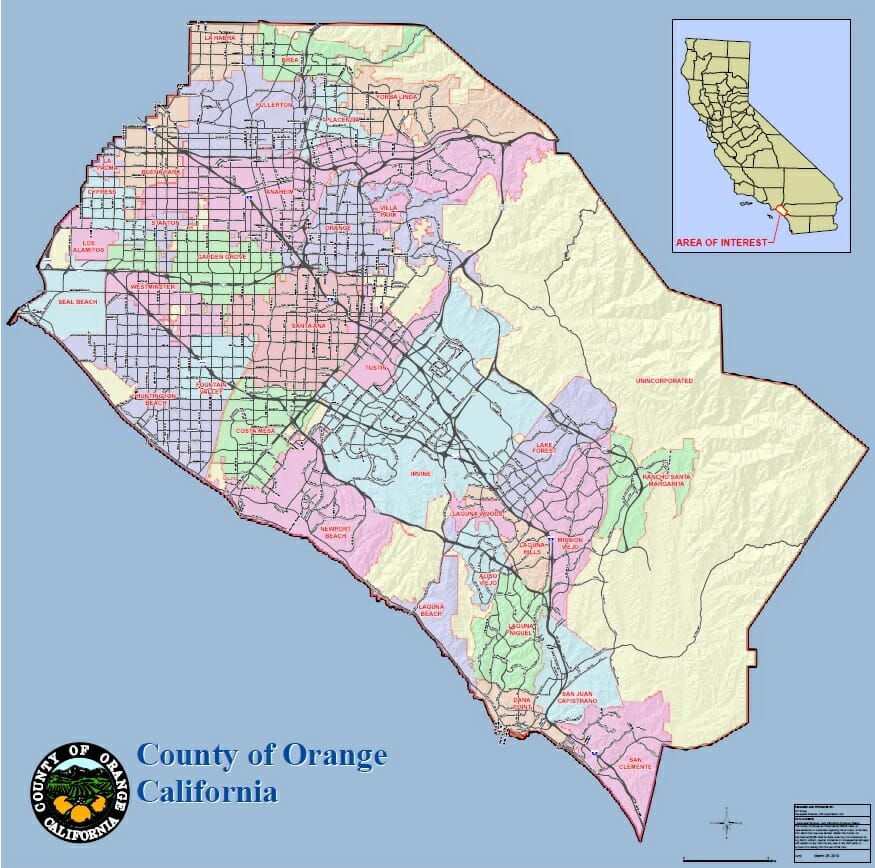

. The base state sales tax rate in California is 6. County of Orange. Average Sales Tax With Local.

The mandatory local rate is 125 which makes the total minimum combined sales tax rate 725. The average sales tax rate in California is 8551. Has impacted many state nexus laws and sales tax collection requirements.

This is the total of state and county sales tax rates. We normally expect to receive payments electronically 1-2 days before the April 11 deadline. May 5 2021 Notice of Unpaid.

82 rows The Orange County Sales Tax is 025. The minimum combined 2022 sales tax rate for Orange County California is. The California state sales tax rate is currently.

Sales Use Tax in California. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. Sales Tax Breakdown.

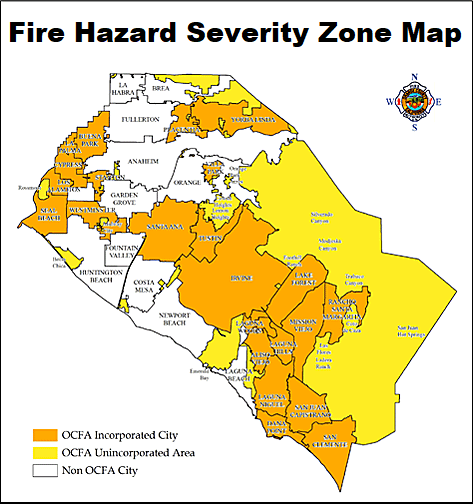

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. The Sonoma County sales tax rate is. A county-wide sales tax rate of 025 is.

Some information relating to property taxes is provided below. PayReviewPrint Property Tax Bill Related Information. Box 1438 Santa Ana CA 92702-1438.

The last timely payment date for the second installment is April 11 2022. Orange County Tax Certificate Sale 2021 Link Procedures for the 2021 Tax Certificate Sale Link 2021 Tax Certificate Sale Affidavit Link Notice of Unpaid Delinquent Tangible Personal Property. An average local tax of 2 Before we continue to discuss quickfacts orange county california quickfacts provides statistics for all states and counties and for cities and towns with a population of 5 000 or more Simulador Co Calculo Do Valor Patrimonial Honesty is Absolutely Vital On the Path Of Awakening Dan.

Sales tax in California varies by location but the statewide vehicle tax is 725. Internet Property Tax Auction. The 2018 United States Supreme Court decision in South Dakota v.

Currency only paid in person at the Office of the Treasurer-Tax Collector in the County Service Center located at 601 N. 2018 Merit Increase Percentage orange County California. The sales tax also includes a 50 emissions testing fee.

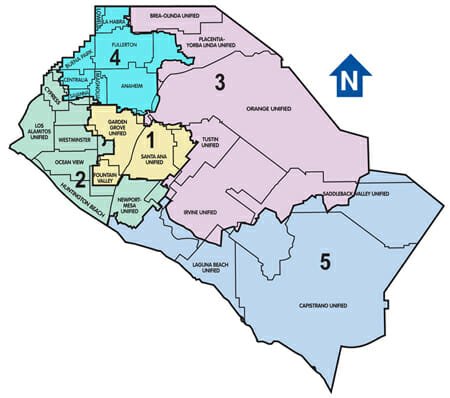

The local government cities and districts collect up to 25. California has 2558 cities counties and special districts that collect a local sales tax in addition to the California state sales taxClick any locality for a full breakdown of local property taxes or visit our California sales tax calculator to lookup local rates by zip code. Find your California combined state and local tax rate.

Of the 725 125 goes to the county government. This is the total of state and county sales tax rates. The December 2020 total local sales tax rate was also 7750.

California has state. If you need access to a database of all California local sales tax rates visit the sales tax data page. This office is also responsible for the sale of property subject to the power to sell properties that have unpaid property taxes that have been delinquent over five years.

The Orange County sales tax rate is. Method to calculate Orange County sales tax in 2021. The California state sales tax rate is currently.

The Office of the Tax Collector is responsible for collecting taxes on all secured and unsecured property in Orange County. 2021 the internet website of the California Department of Tax and Fee Administration is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 Level AA success criteria published by the Web. 6 rows The Orange County California sales tax is 775 consisting of 600 California state.

The combined rate used in this calculator 775 is the result of the California state rate 6 the 92868s county rate. Sales Tax Calculator of 92868 Orange for 2021 The 92868 Orange California general sales tax rate is 775. The 2018 United States Supreme Court decision in South Dakota v.

The minimum combined 2022 sales tax rate for Sonoma County California is. 1788 rows California City County Sales Use Tax Rates effective April 1 2022 These. IMPORTANT INFORMATION FOR MORTGAGE COMPANY PAYMENTS.

2021-22 SECURED PROPERTY TAX BILLS. Local tax rates in California range from 015 to 3 making the sales tax range in California 725 to 1025.

Orange County Ca Property Tax Calculator Smartasset

40188 Esterly Ln Big Bear Lake Ca 2 Beds 1 Bath Big Bear Lake Big Bear Home Ownership

California Sales Tax Rates By City County 2022

Sales Tax In Orange County Enjoy Oc

Payroll Services Tax Hr Orange County Ca Primepay

Food And Sales Tax 2020 In California Heather

84 000 A Year Now Qualifies As Low Income In High Cost Orange County Orange County Register

Orange County Ca Property Tax Calculator Smartasset

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

Orange County Ca Property Tax Search And Records Propertyshark

The Santa Ana Winds Blow Into Southern California During The Fall And Winter Months Typically From October To February Read On To L In 2022 Santa Ana Wind Beach Fire

Who Pays The Transfer Tax In Orange County California

Orange California Ca Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders